People. Product. Position.

For more than 10 years, MENTOR has used this formula of factors to create a solid foundation, leading to the generation of wealth for principals and shareholders. The convergence of people, product and position across industry verticals, makes MENTOR’s approach unique among investment companies. The combination of seasoned portfolio companies and strategically chosen early stage investments has allowed MENTOR to leverage a winning convergence of resources to support long-term growth.

MENTOR's investment criteria are not confined by heavy reliance on certain industries. The existing portfolio and areas of interest encompass a wide variety of areas:

- Business and Financial Services

- Consumer, Distribution and Logistics

- Healthcare and Life Sciences

- Industrial Technology

- Information and Media Technology

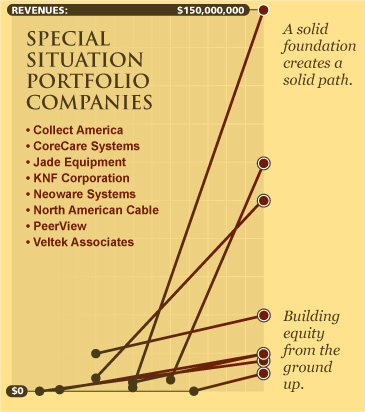

The following are selected Portfolio Companies financed by MENTOR and its affiliated fund, Mentor Special Situation Fund, L.P. From 1994 to 2000, a wide variety of Special Situation investments were made covering venture capital, expansion, leveraged buyouts and micro-cap public companies. The chart highlights a majority of these investments and their growth.

As a result of the Internet meltdown and overall stock market decline in 2001, raising early stage capital became very difficult. In that climate, we began working with founding company management teams to attract capital serving in a role as co-founders to accelerate the capital raising process. Since then we have completed transactions with the companies generally referred to as Early Stage which has become the newly recognized “sweet spot” of value in the venture capital industry.

The nature, timing and amount of managerial assistance provided varies, depending upon the specific requirements of each portfolio company.

One of our key strengths is the ability to identify and work with management of varying types, across industry and stage of company. We believe that this has been a key factor in delivering superior results under a variety of circumstances.

We encourage anyone seeking to obtain financing, proposing acquisition candidates, corporate or strategic partnering or joint ventures, should contact executives at any of the portfolio companies listed below.

In all cases, MENTOR has focused on its supportive role with management, making recommendations for change, if need be, and helping management build on existing strengths.

Special Situation Portfolio Companies

Exited Investments Exited Investments

A financial service company that purchases non-performing credit card debt and obtains other debt placements from credit-granting organizations for distribution to its proprietary national network of franchised law firms. This network utilizes Collect America's proprietary technology including computer database, collection software and communication system and collection methodology and operating philosophy.

A regional provider of behavorial healthcare treatment for Eastern Pennsylvania offering acute psychiatric, drug and alcohol, adoloescent residential treatment and clinical aversion therapy (methadone) for the opiat dependent population in Greater Philadelphia, and conducts CNS (central nervous system) drug testing through its subsidiary Quantum; all located at the former Institute of the Pennsylvania Hospital which was acquired in 1997. (NASDAQ - "CRCS.PK").

A leading manufacturer of build-to-customer-specification precision automated assembly equipment which expects to expand its customer base through acquisitions. JADE has been providing over 50 years of innovative manufacturing solutions to the pharmaceutical, medical, chemical, industrial and telecommunication industries offering contract manufacturing and precision stamping production.

The fastest growing nylon and polyethylene blown film extruder and converter servicing the aerospace, chemical, medical, food and electronic industries. Through its flexible packaging subsidiary, a wide variety of bags, pouches, tubing and sheeting products and specifications are provided. Its turnkey Class 100 cleanroom manufacturing facility converts a spectrum of Ultraclean Film for a variety of industry applications.

Neoware acquired Activ-e Solutions, Inc. which was an initial investment formed as an Applications Service Provider (ASP) that specialized in the use of Citrix technology for high-speed access to Windows NT and Unix business applications. Neoware is a global leader in the thin client server-based computing market with the broadest industry product platform sold worldwide through a network of trained, authorized business partners, including IBM which has a minority ownership position. (NASDAQ - "NWRE").

A full line stocking manufacturer and distributor of commercial and residential satellite and CATV installation materials. NACE has stocking locations in PA, MO, NV and FL and sales offices in PA, VA, KY, OK and FL. Product lines include: commercial headend electronics, coaxial cables, multimedia cables, security cables, category cables, surge protectors, residential digital agile modulators with infrared capabilities, tools, patch cords, televisions mounts and a wide variety of installation materials. NACE also has a fully staffed headend assembly laboratory that builds professional-quality private cable systems.

PeerView provides a growing range of web-based decision-support, program management and competitive intelligence products that support publication strategy and other commercialization processes. Customers include many of the leading pharmaceutical and biotech companies, and a growing number of the innovative scientific communications agencies that support the industry's publication strategy initiatives.

Veltek is a single-source supplier of innovative solutions designed to control particulate and microbial contamination in pharmaceutical and biotechnology operations. The company's sterile chemical, environmental control monitoring and disposable products and lab testing services are offered worldwide. |